Hi,

I learned something new this week. I came across how the rise in popularity of index funds is shifting the balance of power from bankers/policy makers to asset managers.

It made me realise, that even though index funds are a great vehicle to build wealth for people like you and me it comes at a cost of concentrating power in the hands of a few unelected leaders from BlackRock, Vanguard and other similar entities.

Does it mean index funds are a bad product?

What are index funds?

Index funds are those that mimic an underlying benchmark such as S&P 500, Nifty 50 or Nifty Top 100.

They take the pool of money raised from investors and buy shares of companies that comprise the target benchmark. It’s passive investment philosophy means that it does not take any active decision such as picking which stock to buy/sell or engage in market timing.

The goal is to earn the benchmark return at a low cost for investors.

Their low-cost (yet high performing) nature has made them incredibly popular with retail investors who have been increasingly participating in the market via these passive funds.

How large are the index funds getting?

BlackRock, Vanguard and State Street are some of the largest players in the passive investing universe. Collectively they are called ‘the Big Three’.

The Big Three, combined own 13.58% of Tesla, slightly higher than Musk’s stake of 13.42%.

A caveat, the Big Three also have active funds. So, their combined 13.58% is distributed across active and passive funds.

For nine in ten companies on the S&P 500, their largest single shareholder is one of the Big Three. For example, the Big Three together hold 15.99% of Apple. Their ownership of smaller companies is even more concentrated.

This has led to passive funds owning more of the US stock market than actively managed funds. Meaning investors are putting more of their dollars into passive funds.

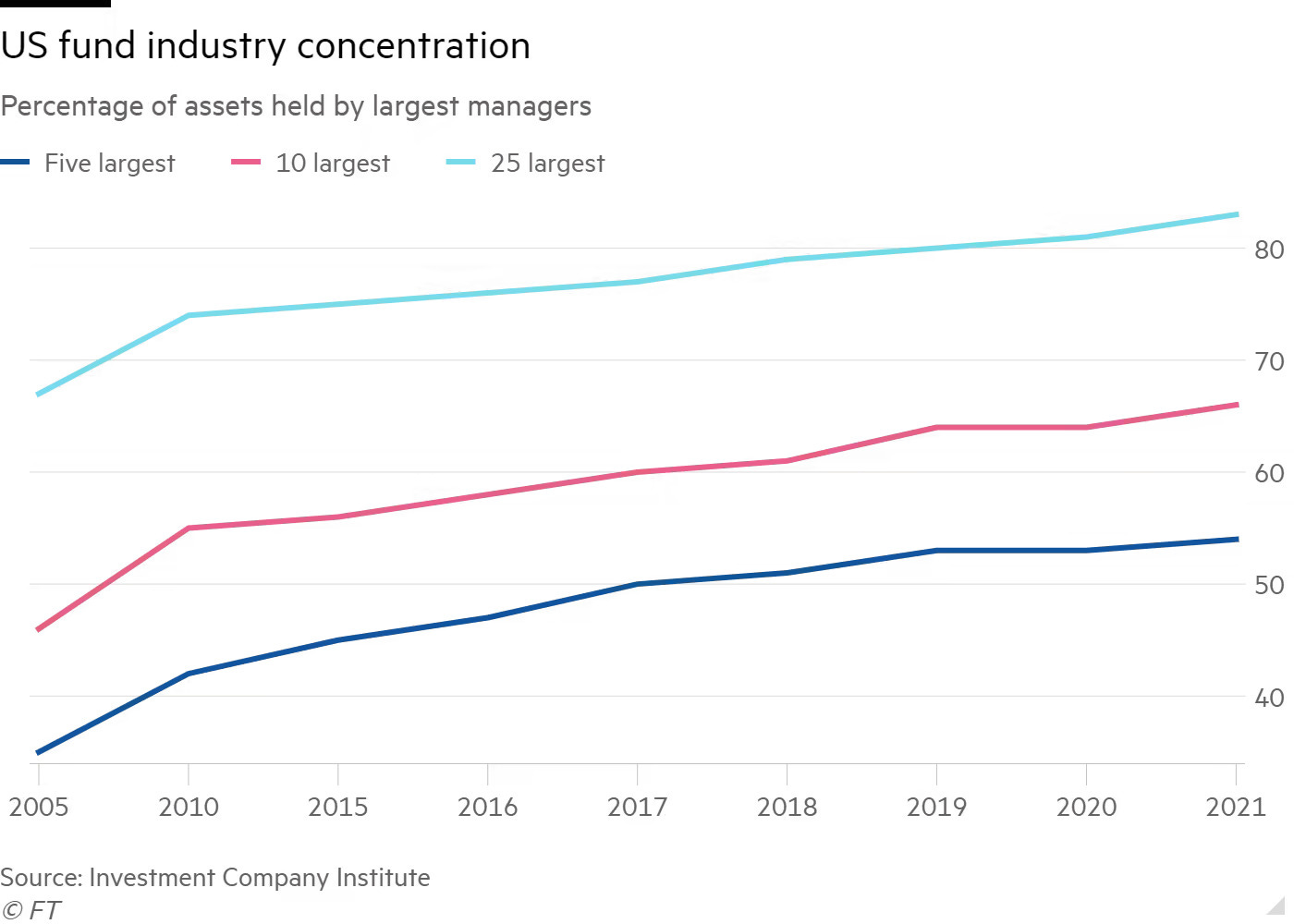

The problem is - the fund managers remain the same- The Big Three and their peers. The 10 largest fund houses manage upwards of 66% of the total passive assets.

Concentration of Power

The problem with this is that it causes a concentration of ownership. This leads to voting power being held in the hands of a few people and increasing asset managers’ influence in the company.

As per Charlie Munger, the billionaire vice-chairman of Berkshire Hathaway

“We have a new bunch of emperors, and they’re the people who vote the shares in the index funds,” Munger said at the annual meeting of Daily Journal Corp. “I think the world of Larry Fink, but I’m not sure I want him to be my emperor.”

Munger’s words reflect an increasing concern of some regulators, policymakers, academics, and politicians, that the balance of power is tilting towards fund houses.

Who else isn’t happy?

Elon Musk doesn’t seem too happy about index funds owning more of his company than he does. And he isn’t the only one complaining about their influence. Others like Marc Andreessen are also unhappy about the situation.

What they are implying is that the fund managers of the passive fund companies are pushing their own agenda over what other shareholders want due to their outsized influence. In the case of this Twitter conversation the push towards ESG was under discussion.

Why does this matter?

Researchers have found a mixed bag of repercussions to this phenomenon.

Some say that it reduces competition.

As the mega- asset managers own Tesla and Tesla’s competitors- the incentive gets skewed. Their intention might not be to grow and capture market share but ensure the entire industry is profitable. This could lead to collusion amongst companies by raising prices for consumers or squeezing suppliers. Leading to the emergence of monopoly giants.

Another problem is that index-linked investing is increasing correlation, whereby the prices of stocks, bonds, and other assets move up or down or sideways together.

As the financial economist Jeffrey Wurgler has written, the price fluctuations of a newly indexed stock “magically and quickly” change. A firm’s shares begin to move “more closely with its 499 [for S&P 500] new neighbors and less closely with the rest of the market. It is as if it has joined a new school of fish.”

What does the future hold?

Two things are for certain- passive investing is on the rise and the incumbents market share is only increasing.

John Bogle, the founder of Vanguard 500 Index Fund, the first fund to track the returns of the S&P 500 said,

“If historical trends continue, a handful of giant institutional investors will one day hold voting control of virtually every large U.S. corporation. Public policy cannot ignore this growing dominance, and consider its impact on the financial markets, corporate governance, and regulation. These will be major issues in the coming era.”

My take

I have invested a chunk of my savings into passive funds namely the Nifty Top 50, Nifty Top 100 and S&P 500 and will continue to invest in them. For me they are a safe bet - consistent returns, low cost and I plan to hold on them for 10+ years.

The concentration of power does not affect my portfolio. But knowing about it now I want to see how the stock market will play out 20 years down the line.

Will the popularity of index investing wane? Will active funds outperform index funds as inefficiencies in the market arise? Will the market regulators such as SEBI, SEC interfere?

I don’t know.

But to answer the first question - Does it mean index funds are a bad product?

They are a great product for me, for now.

Additional Reading

FT Alphaville is fast becoming one of my favourite publications. They wrote about who they think are the financial industries New Emperors. Read the article here.

I hope you enjoyed this edition of Filtered Kapi. Do consider sharing it with your friends and family, as it helps me get a broader audience.

Do let me know if something struck a chord with you.

Filtered Kapi #41 Someone sent you this?