So, who lost out when UBS took over Credit Suisse?

The $3.25 billion deal that has everyone talking

Hi,

The recent Credit Suisse saga has thrown up two questions for me

Why was a distress sale necessary?

Who is the loser in all of this? Shareholders, debtholders, taxpayers, depositors?

Let’s dive in,

A takeover which feels like a raw deal

On 19th March 2023, UBS bought its rival Credit Suisse for a mere $3.25 billion, in a deal forced by the Swiss authorities. This was a pittance considering Credit Suisse’s book value.

The Swiss goliath, as per its 2022 annual report, held assets worth ~$573 billion and had a market capitalization of ~$8 billion at the end of December 2022.

So, paying the shareholders only $3.25 billion feels like a dirty move.

A questionable recent track record

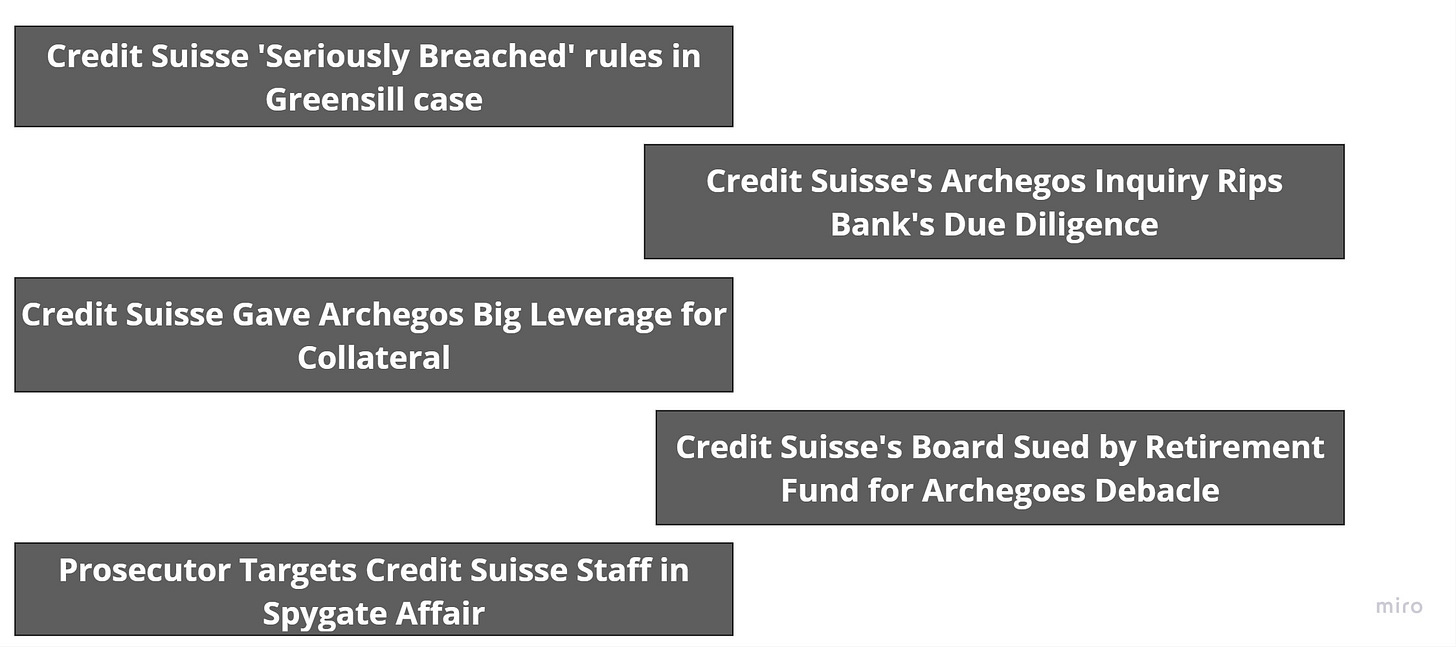

Credit Suisse has a storied history of 167 years, but the bank’s recent history is littered with questionable billion-dollar bets. Lately, the bank has been in the news for all the wrong reasons (see headlines below). This was leading to creditors losing trust in the bank.

As per Bloomberg,

Credit Suisse’s failings included a criminal conviction for allowing drug dealers to launder money in Bulgaria, entanglement in a Mozambique corruption case, a spying scandal involving a former employee and an executive and a massive leak of client data to the media. Its willingness to engage with clients that some other banks avoided, such as disgraced financier Lex Greensill and failed New York-based investment firm Archegos Capital Management, lost it billions of dollars and compounded the sense of an institution that didn’t have a firm grip on its affairs.

In late 2022, the bank was faced with unprecedented client outflows. The loss of business was especially dramatic in Asian wealth management, which for many years had been an important source of profit growth.

Moves to restore confidence

While Silicon Valley Bank was collapsing due withdrawals by depositors, Credit Suisse was bleeding $10.8 billion of client’s money daily. Chief Executive Officer Ulrich Koerner knew they needed to gain some goodwill to survive. This led to them taking a couple of actions to reassure the market everything was okay.

1. Credit Suisse secured a line of credit to borrow $54 billion from Swiss National Bank (SNB), the country’s central bank. So, if savers wanted their money back the bank would be able to honour their request, without having to liquidate its asset portfolio at a loss.

This also sent a signal to the bank’s creditors, that the Swiss authorities were backing them.

2. Credit Suisse offered to buy back its debt at a significantly higher price.

They had to pay ~$1.9 billion to their debt holders by the end of April. Under normal circumstances, it would have to pay back the entire sum of $1.9 billion, all 100 cents on the dollar. But as the bank standing deteriorated, the debt was trading at 92.6 cents on the dollar.

Credit Suisse offered to buy back the debt at 98 cents, ~6% higher than market rates, to show to creditors it has the funds to fulfill its obligations. It was a show of strength to the market.

Credit Suisse would have potentially saved $70 million (100-98) if the plan to buy back its debt went through.

But it would rather have the plan fail - to have no one show up to sell bonds at these prices — and miss saving the $70 million - as this would mean that the market trusted its ability to repay.

$70 million for Credit Suisse was a rounding error considering their profit and loss statement runs in the billions.

The market was telling Credit Suisse - we question your ability to repay, Credit Suisse was saying - I am a good borrower, here let me prove it to you.

Credit Suisse needed the support of its creditors, as banks rely on the debt markets for funding, and if the market believes you are a sinking ship, they won’t loan you money.

A surprise and an ultimatum

While Credit Suisse was trying to put on a show of confidence, two things happened.

The chairman of Saudi National Bank, Ammar Al Khudairy , Credit Suisse’s largest shareholder, was asked if they would put in any more money to save its investment, the chairman replied “absolutely not”.

The stock price fell by 31%.

Prices in the financial world, synthesize information. They contain all the data and information about the company available in the market. It is the single decision point that traders look at, and a significant fall in price signals sell, sell now.

In the same meeting where they authorized the $54 billion backstop, the Swiss authorities delivered another message to Credit Suisse: “You will merge with UBS and announce Sunday evening before Asia opens. This is not optional,” a person briefed on the conversation recalls.

Looking for a way out and landing up in UBS’s arms

Switzerland became a banker to the world’s rich by offering reliable services with discretion.

With Credit Suisse’s name being dragged through the mud, it was putting a dent in the Swiss brand name, and shaking the implicit trust people have in the global banking system.

There was pressure from the US and French authorities to resolve the issue and stop a bank run. To protect its national interests, the Swiss central bank started looking at other options for Credit Suisse.

A government-controlled wind down would be a disaster for the financial system, as it could ignite the threat of contagion around the world.

The authorities were averse to using taxpayer funds to bail out the bank as it had done for UBS back in 2008. Public anger at that arrangement still endures today and a repeat was politically unthinkable.

So, the only viable option was a buyout or a merger.

Enter BlackRock’s Larry Fink, he and his team were interested in owning a stake in the bank.

From prior experience, in 2019, BlackRock bought Barclays’s investment arm BGI and transformed it into a behemoth managing $8.6tn. They spied a similar opportunity in Credit Suisse’s troubles.

But the complexity and timeframe meant that no arrangement could be reached. And an outsider was not palatable to the Swiss authorities either. Thus, they landed on the other goliath, UBS.

To be fair it was an attractive option for UBS, annihilate the competition and be the last one standing. But for the management team of Credit Suisse, if the authorities were going to force this merger through, the stakeholders needed to be fairly compensated.

The initial offer was for $1 billion. Credit Suisse’s management team declined.

The Swiss authorities nudged UBS to pay more. Ultimately, UBS boosted the offer to $3.25 billion, all stock deal, Credit Suisse shareholders would receive proportionate UBS shares. In return for a higher price UBS negotiated more support from the state, in the form of a bigger credit line, a loss guarantee to be borne by the government above a certain limit and protection against regulatory probes into Credit Suisse’s culture and controls.

The bottom line

While Credit Suisse was in a bind and had to take some action to stop everyone from beating them, the price which all the shareholders got was a pittance because UBS went, if we don’t buy the stock the price is going to fall to 0 so here take pennies on the dollar and please don’t be a sore loser.

The buyer had the upper hand, the resulting price makes that clear.

So, who is the loser in all this?

Well everyone other than UBS.

Employees might get fired, shareholders lost a lot of money, tax dollars will be funding UBS’s monopoly, savers will have less choice where to park their money.

But what about the counterfactual, if the authorities said not my problem and there was a bank run, would everyone have been worse off? I think yes as this could cause global panic and once people lose faith in the system its a herculean task to get it back.

But, why is it so important to protect people’s trust in banking infrastructure? You can read the answer here.

My takeaway is that even seemingly decent banks, like Credit Suisse and Silicon Valley Bank which complied with the rules and regulations, take risks which don’t pan out leading to huge losses.

We all have made some bad bets- I invested in crypto and lost a lot! Their scale is bigger, and they have borrowed money from regular folks.

But once you lose trust it takes a miracle to gain it back. During times of market turmoil, the companies in which people have lost faith are the first to fall.

And currently it feels like we are living in turmoil, every day I am reading about things which is beyond my understanding - AI, DeFi, maximising credit card points etc. The only life jacket we have is a good reputation.

I hope you enjoyed this edition of Filtered Kapi. Do consider sharing it with your friends and family, as it helps me get a broader audience.

Do let me know if something struck a chord with you.

Filtered Kapi #42 Someone sent you this?

Absolutely loved the ending and what a stunning post. Keep writing And thank you for sharing this with us. This is really good work!